When you drive off the lot with a brand-new car, you're filled with excitement—savoring the smooth acceleration, the pristine interior, and imagining all the road trips ahead. What you’re not thinking about? The possibility that in just a few weeks, that car could be declared a total loss by an insurance company.

It happened to me once. My car was parked outside a sandwich shop in Phoenix, Arizona, when another driver accidentally backed into it—hard. I came outside to find the entire rear end crushed and my Chevy HHR pushed up onto an embankment. The insurance company deemed it a total loss. I wasn’t even behind the wheel at the time.

A similar fate befell my friend Ashley last year. She and her family had just purchased a beautiful, brand-new 2024 Audi Q5e. After enjoying it for a mere three weeks, they took a trip to a cabin in Wisconsin. One summer evening, a powerful thunderstorm swept through the area. By morning, they discovered a massive tree branch had crashed onto their car. The windshield was shattered, and the driver’s seat was impaled. Fortunately, no one was inside.

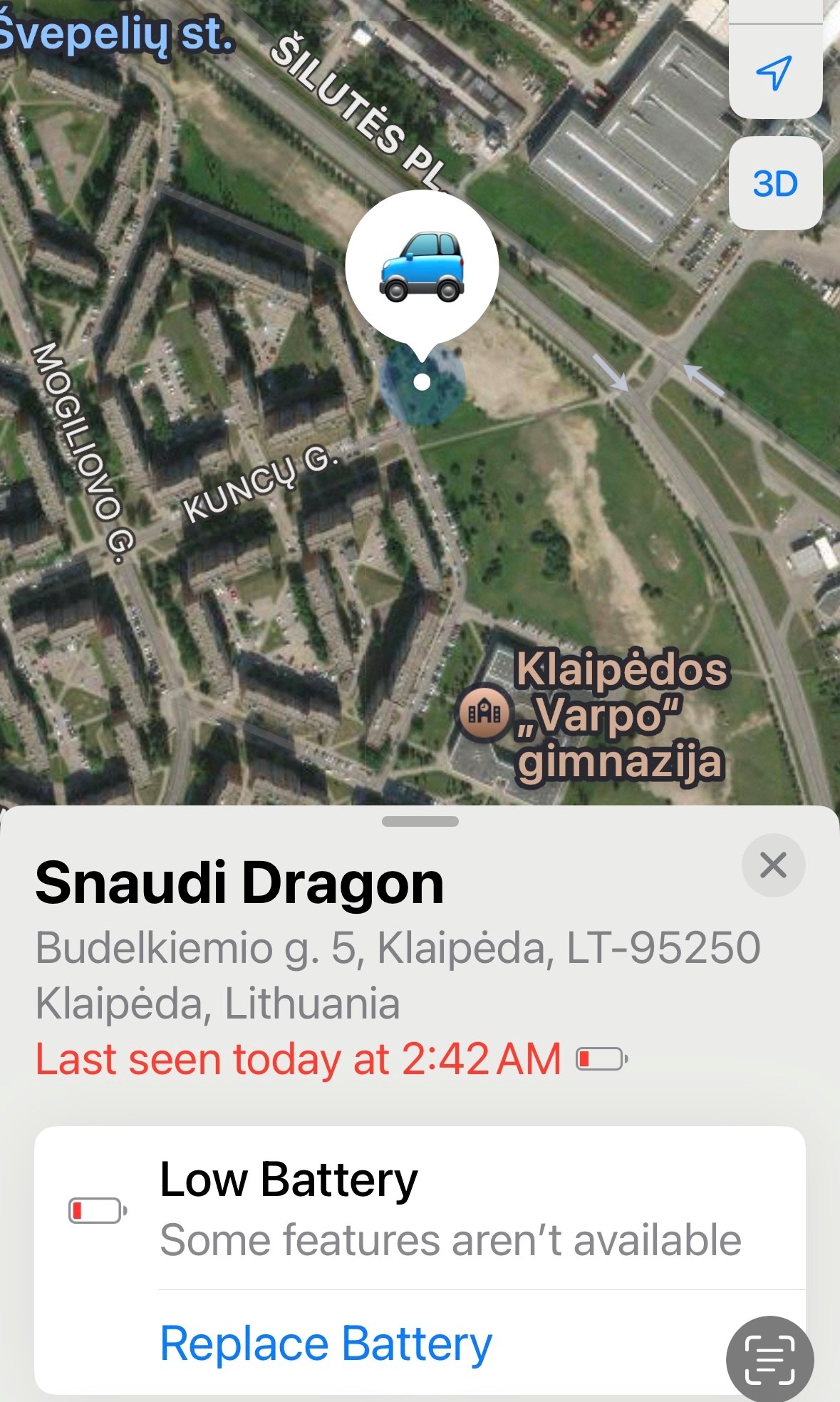

A couple of weeks later, Ashley’s insurance company delivered the news: her beloved "Snaudi Dragon" was a total loss. She went to the auto body shop to retrieve her belongings before the car was towed away for parts-stripping and eventual demolition.

But here’s where the story takes an unexpected turn. Ashley’s husband, Mark, had placed an Apple AirTag inside the car’s sunglasses compartment. Out of curiosity, he checked its location a few days later. To their surprise, the AirTag showed the car at an auction site in Appleton, Wisconsin. Then, it moved again—to a port in New Jersey. The next ping? Waltershofer Hafen, Germany. Finally, the AirTag’s last known location: Lithuania.

Ashley had assumed her totaled car would be stripped for parts in the U.S. Instead, it embarked on an international journey. But why? And how common is this?

As a writer in the supply chain space, I had questions. How many cars are totaled in North America each year? Where do they go? Is it more profitable to ship them overseas than to dismantle them for parts? Are these vehicles repaired and resold in markets with looser safety regulations? And what does all this mean for automakers as they plan their supply chains—can any components be salvaged and reused? Are manufacturers designing vehicles with end-of-life considerations in mind, ensuring materials are recyclable or environmentally friendly?

In this article, we’ll break down the lifecycle of a totaled car, explore where they go, and uncover the far-reaching implications for the global supply chain. Spoiler alert: it's a lot more complex—and profitable—than you might think.

The totaling of cars: Just how many are we talking about?

According to LexisNexis Risk Solutions data compiled for Axios, the share of vehicles deemed totaled in collisions hit an all-time high of 27% in 2023. That's up from 19% in 2018.

While that number sounds staggering, it reflects the continuous churn in the automotive industry. Whether the damage is from accidents, severe weather, or other factors, these cars still hold significant value elsewhere in the supply chain.

What happens to a totaled car?

Once a vehicle is declared a total loss, it embarks on one of several journeys. Let’s explore the most common routes:

Stripping for parts: The most profitable option

Salvage yards and auto recyclers often dismantle totaled cars to recover usable components like engines, transmissions, catalytic converters, alternators, and airbags. According to the Automotive Recyclers Association (ARA), up to 80% of a vehicle’s parts can be reused, depending on the extent of the damage.

High-demand parts, such as wheels, doors, and bumpers, are sold at a fraction of their original cost, making auto part recycling a booming industry. A recent report from Coherent Market Insights estimates that the value of the global automotive parts remanufacturing market will reach US$ 78.09 billion in 2025 and is expected to surpass US$ 140 billion by 2032.

Some components—especially catalytic converters—are particularly valuable due to the precious metals they contain, including platinum, palladium, and rhodium. These materials are carefully extracted and sold on the market.

Shipped overseas: A global market for totaled cars

Not all totaled vehicles are dismantled domestically. Many are exported to international markets where they are either refurbished and resold or stripped for parts locally. According to the U.S. Department of Commerce, the U.S. exported over 941,000 used passenger vehicles in 2019, a significant portion of which were deemed total losses.

In regions like Mexico, Africa, and the Middle East, demand for used vehicles is high. Older models considered too costly to repair in the U.S. may still be roadworthy elsewhere. In some cases, local mechanics repair and resell these vehicles at a fraction of the price of new ones.

In other instances, these exported vehicles are simply harvested for parts. Engines and transmissions, in particular, are valuable commodities in markets with limited access to new auto parts. In sub-Saharan Africa, for example, this process keeps vehicles affordable and supports a thriving second-hand car economy.

The growing role of electric vehicle (EV) total losses

As electric vehicle adoption grows, so too does the number of EVs declared total losses. EVs present unique challenges due to the high cost of battery replacement. While some follow the same paths as gas-powered vehicles, their batteries require special handling.

Instead of being scrapped, many EV batteries are repurposed for secondary uses—such as energy storage systems for homes and businesses. Some companies are also exploring ways to break down old batteries and recycle their raw materials for new battery production. As the EV market expands, finding sustainable end-of-life solutions for these vehicles will be crucial.

A peek inside the totaled car supply chain

So, who actually manages this massive flow of totaled vehicles? The process typically involves several key players:

Salvage yards: These companies buy totaled cars at auction, dismantle them, and sell reusable parts.

Auto recyclers: Specialized businesses extract high-value materials from vehicles, such as metal, rubber, and glass.

Exporters: Companies that purchase totaled vehicles for resale or parts harvesting overseas.

Auto manufacturers: Increasingly, automakers are considering how to incorporate recyclable or reusable components into new vehicle designs.

The road ahead: Rethinking automotive end-of-life logistics

As the global demand for vehicles and parts continues to rise, the supply chain of totaled cars will remain a critical part of the industry. Manufacturers are increasingly being challenged to consider the full lifecycle of their vehicles—not just how they’re built, but how they’re retired, repurposed, or recycled.

From salvage yards in North America to bustling ports in Europe and Africa, totaled cars are anything but junk. Instead, they fuel an intricate, profitable, and often surprising global supply chain.

So the next time you see a wrecked car on the side of the road, consider this: it might not be heading for the scrapyard at all. It could be on its way to an entirely new life—half a world away.

Dive into more Trade Secrets and discover the unexpected ways the world moves